02-03

News

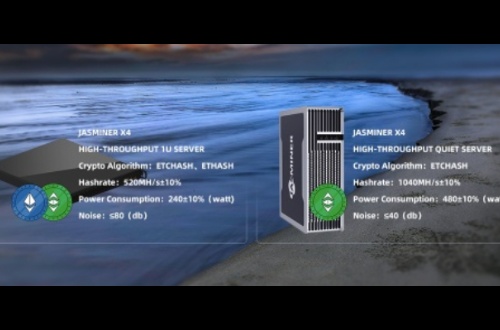

The cryptocurrency market has recently declined and is still trembling. In other words, the lower the power consumption, the less risk-averse the miners.JASMINER X4 High-throughput 1U server is a rig that mainly supports mining Ethereum Classic, with leading level in hash rate and efficiency.

JASMINER X4 mining machine is not affected by the market downturn

The market began to fall,use JASMINER to avoid risk

06-24

Laiye completes the rollout of its first Annual Summit to shape the world of Intelligent Automation20 June 2022 — Laiye Annual Summit, a virtual summit, where Laiye's leadership team examines the state of the intelligent automation industry with other experts for APAC and EMEA region. Pascal Bornet, a global expert and pioneer in Intelligent Automation and Laiye's special guest speaker, joined Laiye experts, to discuss why adopting intelligent automation should be the top transformation priority for global enterprise-level organizations now more than ever.

(WAki International Media Center 22nd June) The speech of The Most Venerable Somdet Phra Mahathirachan (Board member of the Sangha Supreme Council of Thailand Abbot of Wat Phra Chetuphon Vimonmangklaram Rajwaramahawihan President of the Regulatory Office for Overseas Dhammaduta Bhikkhus) on 17th June 2022.

How Ordergo order develops a new economic development model in the Internet era through the sharing economy!

Berry is a global cryptocurrency trading platform. With dual market operating certificates from the U.S. and Canada, Berry performs strict risk control management and runs stably. On March 17, 2022, Berry's daily turnover reached $20 billion.

With the continuous application of AI and 5G technologies, data security issues have begun to attract global attention. As a global intelligent automation (IA) supplier, Laiye has always been in a leading position in the field of IA security, and has been committed to data security with high-quality products and services.

Delhi has moved to the top of the numerous cryptocurrency trading platforms.

According to the official report: jointly launched by MBUS Lab, Canadian First Block Capital (FBC), BLOCKCHAIN CAPITAL Blockchain Capital and many investment institutions, and 10,000 global founders to jointly build the MBUS Swap trading platform will be shocked in July, please look forward to it!