02-03

The phenomenal popularity of IDO surpassed $1,000,000 in 5 days. Can Themis Pro(0x,f4) deployed in FVM lead Fil back to the top?

2023-04-13

2023-04-13

Trading has always been the most enduring topic in the field of DeFi and even web3, which has given birth to many excellent decentralized protocols, such as Uniswap and Curve. These protocols gradually became the cornerstone of the entire system.

In terms of perpetual contracts, the emergence of DYDX brings the order book from the WEB2 era back to web3. The design of its off-chain transactions seems to have returned to the era of smooth transactions on centralized exchanges.

I don’t know if you have noticed, but most of the matchmaking platforms return the right of choice to both parties to the transaction to the greatest extent, so that they can make independent decisions and be responsible for their own profits and losses, thereby avoiding the risks brought by the platform.

On the other hand, these trading platforms are not user-friendly. In addition to the risk of buying and selling the target, the user also bears the risk of excessive slippage loss and unpaid loss.

Uniswap's AMM model does just that. Uniswap agrees on market-making strategies through smart contracts, which greatly reduces the difficulty of market-making for market makers, but equally distributes market-making risks to all LPs, leaving slippage losses to users.

Recently we noticed that Themis Pro (0x,f4) can solve this problem better.

Innovations of Themis Pro(0x,f4)

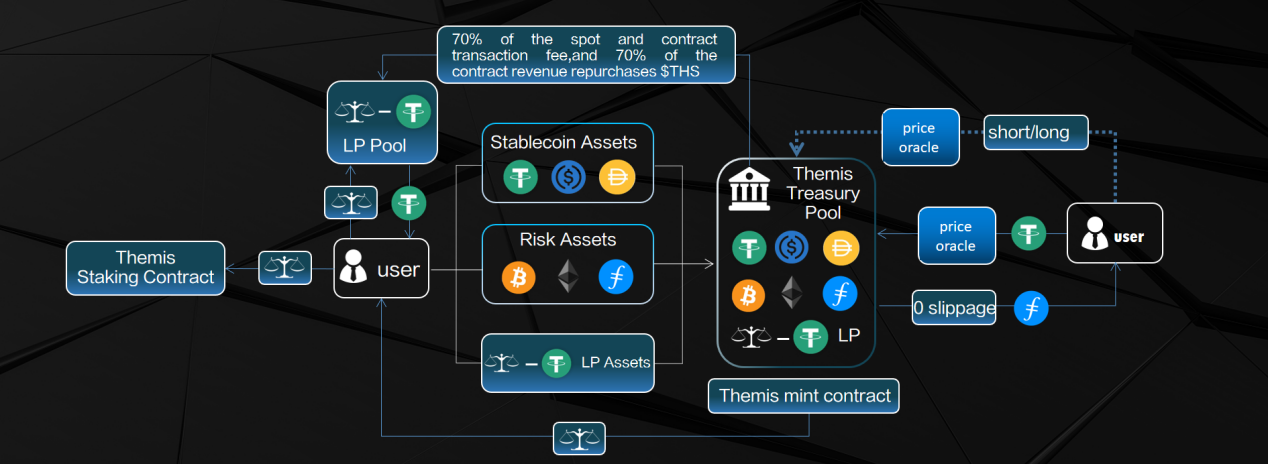

Themis Pro (0x,f4) is a Ve(3,3)-based decentralized spot and derivatives transaction aggregation platform on FVM. At present, the entire team is deploying the FileCoin ecosystem in an orderly manner. Themis Pro (0x,f4) does not use the AMM method, but the Themis treasury fund pool method.

The core advantages of Themis can be summed up in the following four points:

— First-mover advantage of FileCoin ecosystem

— Zero slippage trading mechanism

— Strong revenue feedback capability of the platform

— High capital utilization rate

First-mover advantage of FileCoin ecosystem

On March 14, the Filecoin Virtual Machine (FVM) was officially launched on the mainnet. Since then, Filecoin has been plugged into the wings of smart contracts and has become the golden key to unlock the future data economy. After repeated arguments, the Themis Pro team made a strategic decision to deploy Themis Pro on Filecoin.

Fil has a wide user base. More than 80% of the projects are using or plan to use FileCoin as decentralized data storage, and its currency holding addresses are 2.04 million. Now that the FVM system is ready, we expect that more and more Ethereum applications will be migrated to FVM, and FIL will have more deflationary needs, including locking a large amount of FIL, consuming FIL GAS fees, pledging FIL, etc. This is a good support for the price of FIL, and FVM ecology including Themis Pro will also benefit from it.

At present, Themis Pro is actively laying out the Filecoin ecology, focusing all on FVM, striving to become the leader of Filecoin, including:

1. Themis Labs has built the first the graph node for FVM, which can be used by other developers and belongs to the underlying infrastructure of the public chain;

2. Themis pro, the core product launched by the Themis protocol, is an asset exchange-type decentralized spot and contract exchange. The innovative mechanism can greatly increase the number of locked positions of Fil;

3. Themis will build an AMM-type DEX on FVM to meet the needs of different users;

4. The Themis protocol will also issue FVM-based asset-reserve USD stablecoins (similar to DAI). FIL users can pledge FIL to mint USD stablecoins, greatly increasing the circulation value of FIL;

5. The LSD business of the FVM public chain will be opened soon, that is, Themis Robot, which can obtain a minimum annualized income of 50% to 80% by depositing FIL.

As the first traffic application of the public chain, it is the most attractive to investors. For example, Treasure Dao and GMX on Arbitrum have given the Arbitrum ecology real traffic. In turn, Arbitrum has given more support to the project in terms of technology and publicity. The efforts and achievements of Themis have been recognized by the FilCoin ecological parties, and some FilCoin ecological parties have begun to invest in Themis.

How to achieve zero slippage?

The price of the Themis treasury fund pool is not regulated by the xy=k formula, but the price is obtained from a large CEX through the ChainLink oracle machine to achieve "zero slippage".

For example, what is the price of FIL/USDT off the chain, and the price of FIL/USDT in the fund pool is the price, which is not affected by the size of FIL and USDT in the fund pool. Therefore, when trading in Themis Pro(0x,f4), there will be no excessive changes in the transaction price and market price.

Of course, there are also flaws in the way the oracle machine obtains prices, including the fact that the price source may be incorrect and the transaction volume of the fund pool is insufficient. Themis Pro has established two mechanisms:

In response to extreme situations such as pin insertion, transaction suspension, and hacker attacks on exchanges that cause untrue prices, Themis Pro (0x, f4) has selected multiple information sources for oracle machines, including Binance and Coinbase, and may obtain more in the future. Multiple exchange prices.

Aiming at the problem that the transaction volume of the fund pool may be insufficient, the Themis treasury fund pool is composed of a package of blue-chip cryptocurrencies. There are mainstream encrypted assets such as BTC/ETH/FIL/USDT and stable coins in the pool. The fluctuations of mainstream currencies are relatively small and can bear large Trading volume.

The ratio of risk assets (assets with fluctuating prices) and stable currency assets in the Themis treasury pool is 50/50, fluctuating around 5%. Stablecoin market-making risk is small, the income is stable, and has always been favored by large funds. In fact, the blue-chip asset allocation method of Themis treasury fund pool has a strong absorption capacity. This has been obtained in Themis V1 (the primary experiment of the BSC chain). fully verified.

Let's conclude that the treasury fund pool's configuration of "big funds + blue chips" can support derivatives and spot transactions with large trading volumes. The ChainLink oracle mechanism is responsible for real-time feedback of market prices. Themis Pro (0x,f4) is perfect with zero slippage accomplish.

The benefits of zero-slippage trading to Themis Pro (0x,f4) are obvious, that is, ultra-high leverage is feasible on a perpetual contract platform with low liquidity. Even when the TPS on the chain is not high, users can obtain real-time prices based on the depth of the centralized exchange, in exchange for a better trading experience, and avoid unnecessary losses caused by slippage.

The Value Feedback of Platform Profits

A very important reward mechanism of Themis Pro (0x, f4) is that 70% of the platform revenue is used to repurchase $THS, which is very strong.

We compare Binance’s 22nd quarterly repurchase and destruction in the fourth quarter of 2022. At that time, a total of 2.064 million BNBs were withdrawn from the circulation market, worth 575 million US dollars. With a profit of US$12 billion for the whole year, it can be roughly calculated that Binance takes out 20% of the profit (5.75 times 4 divided by 120) less than the destruction (equivalent to repurchase).

A simple comparison shows that the repurchase of Themis Pro (0x, f4) is more beneficial to users. Moreover, 70% of the repurchase is written in the smart contract agreement, which is open, transparent and verifiable, and is not subject to human control and adjustment.

In fact, the agreement distribution plan has been recognized by the market, and the early liquidity accumulation has been completed quickly.

The remaining 30% is reserved for the long-term development support of the project instead of being put into the pockets of the protocol creation team. These rules are clear and verified to be feasible, which makes the Themis Pro platform quickly gain market recognition, and the platform’s profitability and user growth are positive. flywheel.

With the continuous improvement of the platform user experience, more users have generated more considerable handling fees, and the handling fee share obtained by the platform tokens has increased, thereby increasing the platform currency prices and gaining more market attention, and finally forming an effective and long-term virtuous circle.

High capital utilization

The core reason for the high utilization rate of funds is that "Themis Pro(0x,f4) does not use the AMM method, but uses the Themis treasury fund pool method.".

We mentioned earlier that the zero-slippage trading experience allows the treasury fund pool to undertake more large-value transactions, especially when the Themis treasury holds a large number of stablecoins, Themis Pro will have an irresistible attraction for stablecoin transactions, thereby greatly Significantly increase the utilization rate of treasury funds pool funds.

In addition, Themis Pro (0x, f4) also adopts an automatic fund adjustment mechanism, that is, when a user buys or sells a certain asset, short or long a certain asset will change the stock of different tokens in the pool , so the agreement stipulates that different tokens have different prices for minting THS, so as to balance the proportion of each token in the pool.

We assume that FIL sets a target weight of 20% (adjustable after governance voting).

When the total value of FIL tokens in the fund pool is lower than 20% of the target weight set by the agreement, it means that the treasury fund pool needs to replenish FIL, and the agreement will automatically lower the price of FIL to mint THS, and FIL to mint THS with greater arbitrage space Users will be attracted to use FIL to mint THS, so as to promote the proportion of FIL in the treasury fund pool to gradually approach the 20% set by the agreement.

When the total value of FIL tokens in the fund pool is 20% higher than the target weight set by the agreement, it means that the treasury fund pool does not need to replenish FIL for the time being, and the agreement will automatically increase the price of THS minted by FIL, and the arbitrage space for THS minted by FIL will be It will become smaller or even disappear, and users will temporarily lose the interest of FIL in minting THS, which will automatically prevent FIL from entering the treasury fund pool, so as to promote the proportion of FIL in the treasury fund pool to gradually approach the 20% set by the agreement.

We can see that the price of the target token is adjusted through the agreement, so that the token always maintains liquidity within a certain weight range, which is similar to the principle of algorithmic stable currency. However, the algorithmic stablecoin is anchored by US$1, while Themis Pro (0x, f4) is adjusted by discounts on various blue chips and stablecoin bonds.

In addition, Themis Pro (0x, f4) also realizes the full chain contract transaction of derivatives, especially with the help of the experience-friendly FVM ecology, Themis Pro (0x, f4) can achieve the same trading experience as CEX, avoiding the contract Transaction loss caused by transaction delay.

Are there any defects?

Past experience tells us that innovation often brings potential risks.

In the early V1 version, the young Themis protocol also encountered a bottleneck. At that time, the project was just launched, and various measures were conducive to attracting enough funds into the treasury fund pool. Because of the existence of arbitrage space, users were willing to use funds to mint $THS in the treasury, resulting in the rapid expansion of Themis treasury. As a consequence of this expansion, there are potential inflationary problems. The Themis team is worried that if the new users cannot keep up, in the extreme case of a market crash, liquidity may suddenly dry up and user confidence will be insufficient.

In order to curb inflation, increase confidence in the market, and continuously introduce new external users, Themis introduces the Ve(3,3) model and increases the contribution token $SC participation mechanism. Under the (3, 3) model mechanism, if Themis wants to obtain THS with medium and high returns, it needs to burn $SC, and SC needs to be obtained by inviting users through community preaching. Community evangelism invites users to introduce new users to the system, and medium and high-yield burning SC uses price means to control the output of THS.

for example:

Invite an address to pledge THS worth 1,000-2,000 dollars, and get 0.3 SC token rewards every day; invite an address to pledge THS worth 2,000-3,000 dollars, get 0.6 SC token rewards every day; and so on, For every additional USD 1,000 worth of THS pledged, the inviter can receive an additional 0.3 SC token rewards per day.

We can see that under the encouragement of the Ve(3,3) model and SC tokens, the community has greater confidence in the development of Themis project, and its loyalty is getting higher and higher.

Finally, we conclude again that the Themis project has many innovations, including zero slippage, value feedback, high capital utilization rate, and the whole chain. The advantage is that it is friendly to trading users and LPs. At present, the project is on the track of positive feedback.

Just now, Themis Pro (0x, f4) has completed its strategic deployment, and it will be deployed on FVM first, and fully deploy the FilCoin ecosystem. Soon Fil will also open LSD business. According to the information disclosed by the community, Themis Pro (0x, f4) will also carry out LSD business simultaneously.

The mechanism design of Themis and the Fil LSD business will greatly increase the amount of Fil’s pledge lock-up, which will help support the price increase of Fil. It can be clearly felt that the entire Themis ecosystem is working closely around the outbreak of the Filecoin ecosystem.

Disclaimer: This article is reproduced from other media. The purpose of reprinting is to convey more information. It does not mean that this website agrees with its views and is responsible for its authenticity, and does not bear any legal responsibility. All resources on this site are collected on the Internet. The purpose of sharing is for everyone's learning and reference only. If there is copyright or intellectual property infringement, please leave us a message.